Poland has jumped by as many as 49 places in the Climate Risk Index 2025, ranking countries most affected by climate change, which is yet another signal that these threats are no longer abstract, but are increasingly shaping the real estate sector. Heatwaves, heavy precipitation, droughts and floods have become part of our reality, compelling investors, developers and property managers to conduct comprehensive climate risk analyses. Experts at global real estate services firm Cushman & Wakefield have analysed data from across Poland and identified the most common countrywide and local risks.

A higher probability of climate risks materialising in the real estate market

Amid growing regulatory pressures and climate change challenges, climate risk analysis is becoming not only a component of responsible property management but also a real support for investment decisions. It helps identify threats, plan preventive measures and minimise losses. What’s more, assets resilient to the impacts of climate change are gaining in value, are more frequently chosen by tenants and investors and more easily meet ESG requirements, which are increasingly a prerequisite for securing financing or establishing collaboration with international partners,”

says Katarzyna Lipka, Head of Strategic Consulting and ESG Advisory, Cushman & Wakefield.

Climate risks in Poland

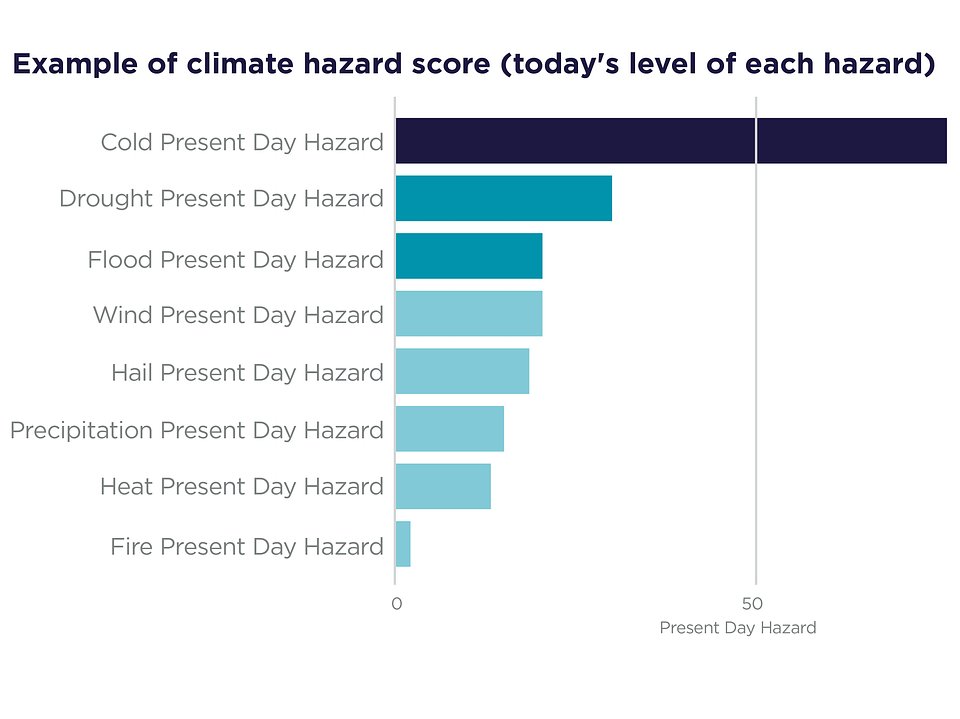

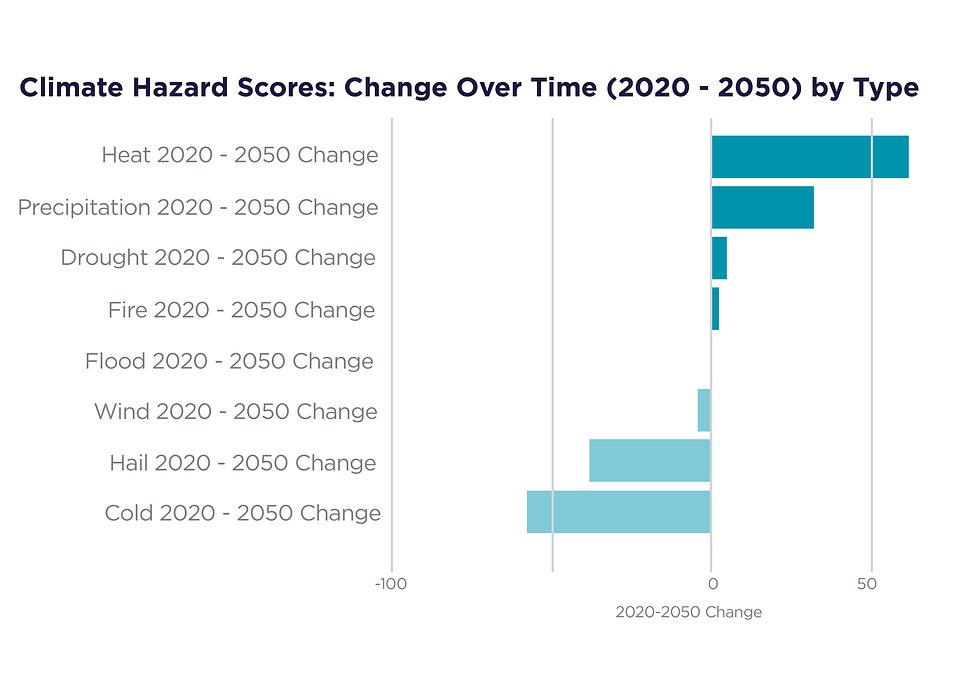

Not only the identification of current threats but also an understanding of their long-term trend is key to planning risk mitigation strategies and managing the negative consequences of their materialisation. For example, low temperatures remain a significant risk in many locations across Poland today, but their impact is gradually diminishing. The opposite trend is observed for high temperatures and heatwaves – currently less severe but increasing in intensity – which could have major implications for asset management by 2050,”

explains Julia Faltus-James, ESG Services Manager at Cushman & Wakefield.

Cushman & Wakefield

Cushman & Wakefield

Good practices in climate risk management – a case study of the industrial sector

- Planned acquisition: Analysis of risk exposure before acquiring an asset enables accurate valuation and informed investment decisions, including knowing when to walk away from a transaction. The report authors say that their data shows a historical lack of accounting for climate risk exposure, leaving value and opportunity on the table.

- Planning and design: Accounting for projected climate conditions at the design phase is crucial – design for future state, not minimum or historical requirements. At this stage, it is possible to adapt the design to climate risks easily and at a relatively low cost – for example by modifying the HVAC system design or incorporating passive solutions to reduce heat gains from solar radiation. Such measures, when implemented during the design stage, can significantly reduce future operating costs and enhance user comfort.

- Asset management: Regular upgrades and infrastructure investments help minimise climate risk, protect assets and tenants, and improve market liquidity – positively impacting valuations, access to financing and lending conditions.

- Divestment: Preparing an asset for divestment requires an assumption that potential buyers will conduct their own risk analyses, as well as transparent communication of mitigation measures.

- Site selection: Climate risk analysis during the short-listing stage facilitates negotiations with landlords regarding risk mitigation, lease terms and duration, and rental rates.

- Planning and design: Accounting for projected climate conditions during the design phase and implementing adaptation solutions and risk mitigation measures will enhance a location’s resilience to change.

- Operational management: When planning OpEx and CapEx budgets and updating business continuity plans, it is important to account for the impact of climate risks – for example, higher temperatures increase air conditioning costs.

- Portfolio management: It will allow for proactive management of an entire portfolio with an eye on future climate risks and, where necessary, will provide reasons for exiting high risk locations.

Climate change, along with requirements such as those in the EU Taxonomy, presents new and tangible challenges for the real estate market. It is necessary not only to identify risks but also to evaluate building resilience and implement effective adaptation plans. Buildings with various uses can exhibit varying sensitivities to specific climate risks. For example, the housing sector, where air conditioning is not widely used, can be particularly exposed to user thermal discomfort during heatwaves. Logistics and warehouse facilities, on the other hand, feature lightweight construction, which results in low heat capacity and high thermal dynamics, making them susceptible to extreme temperatures due to building envelope materials. In such cases, it is advisable to deploy solutions that leverage low heat capacity – for example, free-cooling through quick airing. Strategies that reduce the urban heat island effect, such as high vegetation for shading or rooftop materials with high solar reflectivity, can also be crucial. At Cushman & Wakefield, we support municipalities, investors and property owners throughout these processes – from risk analyses in compliance with EU requirements to technical and operational recommendations. Our goal is to assist in making informed decisions and developing assets resilient to the challenges of the decades ahead,”

concludes Julia Faltus-James.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2024, the firm reported revenue of $9.4 billion across its core service lines of Services, Leasing, Capital markets, and Valuation and other. Built around the belief that Better never settles, the firm receives numerous industry and business accolades for its award-winning culture. For additional information, visit www.cushmanwakefield.com.